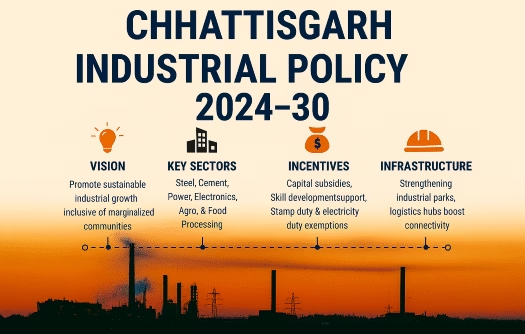

The Chhattisgarh Industrial Policy 2024-30 aims to boost inclusive industrial growth by focusing on key sectors, supporting MSMEs, and promoting investment across the state from November 1, 2024, to March 31, 2030 positioning the state as an attractive destination for entrepreneurs and investors.

Key Objectives

Inclusive growth: special provisions have been introduced for surrendered Naxals, women entrepreneurs, and the third-gender community, highlighting the state’s commitment to inclusive development.

Investment promotion: aims to create an investor-friendly environment to encourage innovation and industrial projects in the state including

- Promotion of green industries, energy-efficient technologies, and circular economy models.

- Support for startups and innovation hubs, especially in Tier-II and Tier-III cities.

Focus Sectors: prioritizes investment and development in key sectors, including:

- Core Sectors: Steel, cement, power, aluminum, and mining.

- Emerging Sectors: Electronics, Information Technology (IT) and IT-enabled services (ITES), biotechnology, renewable energy, and green hydrogen.

- Agro and Food Processing: Boosting value addition in agriculture and forest produce.

Support for MSMEs: The policy aligns the state’s definitions of micro, small, and medium enterprises (MSMEs) with the central government’s amendments issued in 2020, ensuring that small and medium enterprises receive standardized support and incentives. This facilitates easier access to subsidies, financial assistance, and regulatory benefits.

Investment Facilitation: streamlined approvals, potential fiscal incentives, and infrastructure support in targeted industrial cluster.

- Streamlined Approvals:

- Establishment of Single Window System for approvals and clearances.

- Creation of Investment Promotion Board and District Facilitation Cells.

- Regular monitoring and evaluation mechanisms to track policy outcomes.

- Fiscal Incentives:

- Capital Subsidies: For new and expanding units, especially in priority sectors.

- Interest Subsidies: On term loans for eligible enterprises.

- Stamp Duty Exemption: For land acquisition and lease.

- Electricity Duty Exemption: For specified durations.

- Skill Development Support: Reimbursement for training costs and employment generation.

- Infrastructure Support:

- Development of industrial parks, SEZs, and logistics hubs.

- Strengthening connectivity through rail, road, and air networks.

- Focus on digital infrastructure for smart manufacturing and e-governance.

Inclusivity and Social Impact: explicitly addresses social inclusion by focusing on segments of the population historically underrepresented in formal industrial activities including Scheduled Castes, Scheduled Tribes, women entrepreneurs, differently abled individuals, ex-servicemen, and communities affected by Left-Wing Extremism, thereby integrating social development with economic growth.

- Special incentives and support mechanisms are extended to them.

- Certain percentages of land in industrial areas are earmarked for units promoted by these groups.

- Tailored training initiatives for youth and women from rural and tribal areas.

- The policy encourages labor-intensive industries and mandates local hiring to boost job creation, especially in backward districts.

- Promotion of industry clusters based on local resources and traditional skills, such as forest produce processing and handicrafts.

- Integration of forest-based and agro-based industries to support rural economies and reduce migration.

In summary, the Chhattisgarh Industrial Policy 2024-30 provides a structured roadmap to enhance industrial development while promoting inclusivity, supporting MSMEs, and fostering investment in strategic industrial sectors, positioning the state as an attractive destination for entrepreneurs and investors.

Home

Home Syllabus

Syllabus Contact Us

Contact Us