For Basics of State Finance and Budget, please go through Fiscal Policy: Budget, Fiscal Deficit, Public Debt.

Chhattisgarh Budget Analysis (2020-21)

Budget Highlights

| Head | 2020-21 (Revised-RE) | 2021-22 (Estimate-BE) |

| Gross State Domestic Product (GSDP) | Rs 3,50,270 Crore | Rs 3,83,098 Crore 9.4% higher than 2020-21 (RE) |

| Total Expenditure | Rs 96,323 Crore | Rs 1,02,483 Crore 6.4% increase over 2020-21 (RE) |

| Capital Expenditure | Rs 15,676 Crore | Rs 19,455 Crore 24.1% increase over 2020-21 (RE) |

| Revenue Expenditure | Rs 80,647 Crore | Rs 83,028 Crore 2.9% increase over 2020-21 (RE) |

| Total Receipts | Rs 84,345 Crore | Rs 79,645 Crore 18% lower than 2020-21 (RE) |

| Capital Receipts | Rs 22,369 Crore | Rs 19,096 Crore 14.6% lower than 2020-21 (RE) |

| Revenue Receipts | Rs 68,344 Crore | Rs 79,325 Crore 16% increase over 2020-21 (RE) |

| Revenue Balance (-) Deficit | (-) Rs 12,304 Crore (-) 3.51% of GSDP | (-) Rs 3,702 Crore (-) 0.97% of GSDP |

| Fiscal Balance (-) Deficit | (-) Rs 22,838 Crore (-) 6.52% of GSDP | (-) Rs 17,461 Crore (-) 4.56% of GSDP |

| Primary Balance (-) Deficit | (-) Rs 16,597 Crore (-) 4.74% of GSDP | (-) Rs 10,990 Crore (-) 2.87% of GSDP |

- In 2021-22, the sector of Education (19%), Agriculture (17.2%) and Roads and Bridges (7%) saw the highest allocations. Transport saw the highest increase in allocation with 17% increase over the actual estimates of 2019-20 and 40% increase over the 2020-21 (RE).

- In the Budget 2021-22, 38% provision is for social sector, 39% for the economic sector and 23% is for the general service sector.The budget has 34% allocation for ST Areas and 13% for SC Areas.

Receipts

Revenue Receipts:

- The total revenue receipts for 2021-22 are estimated to be Rs 79,325 Crore (16% increase over 2020-21 (RE). Of this, Rs 35,000 crore (44% of the revenue receipts) will be raised through state’s own resources, and Rs 44,325 Cror (56% of the revenue receipts) from central transfers, i.e. state’s share in central taxes and grants-in-aid from the central government.

- In the 2021-22 Budget, Chhattisgarh had estimated a revenue deficit of (-) Rs 3,702 Crore (0.97% of GSDP). In 2020-21 (RE), revenue deficit is estimated to be Rs 12,304 crore (3.51% of GSDP). Fiscal deficit for 2021-22 is estimated to be Rs 17,461 crore (4.56% of GSDP) as compared to 6.52% of GSDP in 20201-21 (RE).

Capital Receipts:

- The total capital receipts for 2021-22 are estimated to be Rs 19,096 Crore, which is 14.6% lower than 2020-21 (RE).

- The main items of capital receipts borrowings are estimated to be Rs 18,776 Crore (15% lower than 2020-21 RE) which include market borrowings and from Banks, loans received from foreign governments.

- Other items include small savings (Post-Office Savings Accounts, National Savings Certificates, etc), provident funds and net receipts obtained from the sale of shares in Public Sector Undertakings (PSUs). They are estimated to be Rs 320 Crore in 2021-22.

| Devolution of Taxes (Corona Effect) |

| 1. In 2021-22, receipts from the state’s share in central taxes are estimated to be Rs 22,675 Crore. 2. There is decrease by 30% for during 2020-21 as per BE and RE due to a 30% cut in the union budget for devolution to states, in RE Budget. Similarly, 3. In 2021-22, receipts from the Grants-in-aid from Centre are estimated to be Rs 21,650 Crore. 2. There is decrease by 15% for during 2020-21 as per BE and RE due to a 30% cut in the union budget for devolution to states, in RE Budget. |

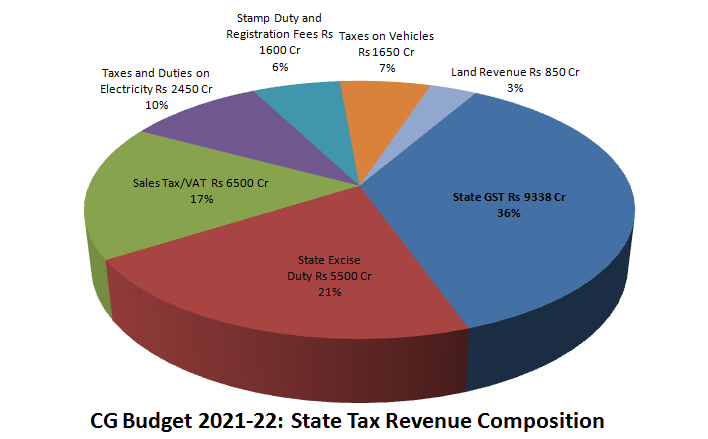

Tax Structure (Composition):

- State Goods and Services Tax (SGST) is the largest component of the state’s tax revenue. It is expected to generate Rs 9,338 Crore in 2021-22. (20% increase from RE 2020-21).

- Total own tax revenue of Chhattisgarh is estimated to be Rs 25,750 Crore in 2021-22 (32% of revenue receipts) which is 14.2% higher than the 2020-21 RE. The composition of the state’s tax revenue is shown.

- Total own non-tax revenue of Chhattisgarh is estimated to be Rs 9,250 Crore in 2021-22 (11.6% of revenue receipts).

- The tax to GSDP ratio is targeted at 6.7% in 2021-22, which is higher than the revised estimate of 6.4% in 2019-20. This implies state’s own tax growth is higher than the economic growth.

Expenditure

Capital Expenditure:

- Capital expenditure for 2021-22 is proposed to be Rs 19455 Crore which include expenditure affecting the assets and liabilities of the state, such as: (i) capital outlay, i.e. expenditure which leads to creation of assets (such as bridges and hospitals), and (ii) repayment and grant of loans by the state government.

- Debt Servicing (Debt Repayment and Interest Payments) for 2021-22 constitutes about Rs 11,847 Crore (11.5% of Total Expenditure). This includes Rs 5,376 crore towards repaying loans, and Rs 6,471 crore towards making interest payments.

- Committed expenditure: Committed expenditure of a state typically includes expenditure on payment of salaries, pensions, and interest. In 2021-22, the state is estimated to spend Rs 39,192 crore on committed expenditure and more than two-third of the state’s committed expenditure (67%) is on salaries followed by pensions and interest payment.

Revenue Expenditure:

- Revenue expenditure includes payment of salaries, pension, and interest, etc.

- Revenue expenditure for 2021-22 is proposed to be Rs 83,028 crore, which is 2.9% increase over 2020-21 (RE).

Policy Highlights

- Rajiv Gandhi Kisaan Nyay Yojana: Rs 5,703 crore has been allocated for providing bonus on paddy procurement. Paddy procurement for kharif 2020-21 was 92 Lakh Tonnes from record 20.5 Lakh farmers.

- Chiraag Yojana: For improvement in the status of agriculture and nutrition in 7 districts from Bastar and Mungeli, with a total outlay of 150 Crore.

- Kaushalya Matratva Yojana: one time monetary assistance of Rs 5000 to the mothers if the second child is also a girl.

- Krishak Jeevan Jyoti Yojana: Rs 2,500 has been allocated towards providing free electricity for agriculture pumps of up to 5 HP.

- Navin Nyay Yojana: for rural agricultural landless labourers of the state

- Mukhyamantri Mitan Yojana: Rs 10 Crore allocated for home delivery of various Govt services.

- Mukhyamantri Shahari Slum Swasthya Yojana: Provision of 50 crore for medical facilities in 14 Nagar Nigams through mobile ambulance and Dai-Didi Clinics.

- SRLM Centers: they are being upgraded as Godhan Nyaya Centers. The remuneration provided to the Swachhata Didi has been enhanced from Rs 5000 to Rs 6000.

- Shri Ram Van Gaman Paryatan Paripath: Provision of Rs 30 Crore

- Swami Atmanand English Medium Schools: 119 new schools will be started with existing 52 schools.

- Mukhyamanti Sugam Sadak Yojana: Provision of Rs 100 Crore for providing approach roads to Government buildings.

- Jal Jeevan Mission: Rs 850 crore for providing tapped waters for every household.

- Mukhyamantri Majra-Tola Vidyutikaran Yojana: Rs 45 Crore for providing electricity connection for the remaining Majra-Tola.

- 11 New Tahsils and 5 Sub-Divions declared.

- Bastar Tigers Special Forece: Special force will be set up in every districts of Bastar Divison with 2800 new recruitments.

- Mukhyamantri Dharsa Vikas Yojana: will be introduced to convert the kaccha road to pucca roads in order to enhance rural connectivity and transportation.

- C-Mart Stores: will be established to provide marketing facility for local agricultural products, forest produce, and food products from the state.

15th Finance Commission’s recommendations for 2021-22

The 15th Finance Commission’s(FC) report for the 2021-26 period was released on February 1, 2021. For the 2021-26 period, the Commission has recommended the share of states in the divisible pool of central taxes to be 41%, same as that for 2020-21 (also recommended by the 15th FC in its report for 2020-21). This is 1% point lower than the 42% share recommended by the 14thFC (for the 2015-20 period) to separately provide funds for the newly formed union territories of Jammu and Kashmir,and Ladakh.

The 15th FC proposed revised criteria for determining the share of individual states (different from 14th FC). Based on the 15th FC’s recommendations for the period 2021-26, Chhattisgarh will have a 1.40% share in the divisible pool of central taxes. This implies that out of every Rs 100 of revenue in the divisible pool during the 2021-26 period, Chhattisgarh will receive Rs 1.40. This is higher than Rs 1.29 recommended by the 14th FC.

The 15th Finance Commission recommended the following fiscal deficit targets for states for the 2021-26 period (as a % of GSDP):

(i) 4% for 2021-22, (ii) 3.5% for 2022-23, and (iii) 3% for 2023-26.

The Commission estimates that this path will allow Chhattisgarh to increase its total liabilities from 28.1% of GSDP in 2020-21 to 31.6% of GSDP in 2025-26. If a state is unable to fully utilize the sanctioned borrowing limit as specified above in any of the first four years (2021-25), it can avail the not utilized borrowing amount in subsequent years (within the 2021-26 period).

Chhattisgarh’s Economy

- Chhattisgarh GSDP is likely to grow to Rs 3.83 Lakh Crore during 2021-22 from 3.45 Lakh crore in 2019-20 at current prices. The growth rate of Chhattisgarh’s GSDP (at constant prices) was -1.8% in 2020-21, which is less than the growth rate in 2019-20 (5.1%).

- The per capita GSDP in 2020-21 (at constant prices) was Rs 82,419, which is 3.3% lower than in 2019-20.

- The growth rate of GSDP (at constant prices) is estimated to be 9.4% in 2021-22 than in 2020-21 (RE). In 2020-21, GSDP is estimated to be 3.2% lower than the Budget Estimate. In comparison, the all India GDP is likely to contracted by 13% in 2020-21 and increased by 14.4% in 2021-22.

- In 2020-21, agriculture, manufacturing, and services sectors contribute by 26%, 38% and 36% to GSDP respectively. During year 2020-21 likely growths in agriculture sector are 4.61%, industrial sector by (-) 5.23% and services sector by 0.75% respectively on constant prices. All India likely growths in agriculture, industrial and service sector are 3.4%, (-) 9.6% and (-) 8.8% respectively for the same duration.

- According to the Periodic Labour Force Survey 2018-19, Chhattisgarh has an unemployment rate of 2.4%, which is significantly lower than all-India unemployment rate of 5.8%

Public Debt Composition

Article 292: Government of India can borrow amounts specified by the Parliament from time to time.

Article 293: State Governments in India can borrow only from internal sources.

Thus the Government of India incurs both external and internal debt, while State Governments incur only internal debt.

Definition:

Public Debt: Debt contracted against the guarantee of Consolidated Fund of India (defined as Public Debt)

- Internal debt: owed to

lenders within the country.

- The government borrows by issuing the Government Bonds and T-Bills (Treasury Bills).

- Securities issued to International Financial Institutions

- Borrowing from RBI under Market Stabilization Scheme (MSS) Bonds for sterilization operations

- External debt: owed to

creditors outside the country.

- The outsider creditors can be foreign governments, International Financial Institutions such as World Bank, Asian Development Bank etc., corporate and foreign private households.

- External debt may be of several kinds such as multilateral, bilateral, IMF loans, Trade credits, External commercial borrowings etc.

- When the non-resident Indians park their funds in India, it is also a type of external debt and is called NRI deposits.

Other Liabilities: Liabilities in the Public Account (called as Other Liabilities):

- Liabilities on account of Provident Funds

- Reserve Funds and Deposits, Other Accounts, etc

- Securities issued against ‘Small Savings’: All deposits under small savings schemes are credited to the National Small Savings Fund (NSSF). The balance in the NSSF (net of withdrawals) is invested in special Government securities.

Outstanding Liabilities: Accumulation of borrowings over the years, expected at 28.3% of the GSDP for 2021-22.

| Year | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 (RE) | 2021-22 (BE) |

| Chhattisgarh | 16.6% | 18.6% | 17.4% | 22.8% | 27.7% | 28.3% |

All India Public Debt as percentage of GDP (2018-19)

| Public Debt External Debts | 40.0% 2.7% |

| Public Accounts | 5.2% |

| Total Liabilities | 45.7% |

| Fiscal Deficit | 3.4% |

Economy of India and Chhattisgarh

Home

Home Syllabus

Syllabus Contact Us

Contact Us