Modeled on the World Bank, the Asian Development Bank was conceived in the early 1960s as a financial institution that would be Asian in character and to promote social and economic development in Asia and Pacific, one of the poorest regions in the World. During the 1960s, ADB focused much of its assistance on food production and rural development.

ADB in partnership with member governments, independent specialists and other financial institutions is focused on delivering projects in developing member countries that create economic and development impact.

| Establishment: 1966 Headquarters: Mandaluyong, Manila, Philippines |

| Motto: Fighting Poverty in Asia and the Pacific President: Takehiko Nakao (Japan) |

| Table of Contents: |

| Aim Focus Areas Membership Decision Making Funding India and ADB Asian Development Outlook |

Aim

- Reducing poverty in Asia and the Pacific through inclusive economic growth, environmentally sustainable growth, and regional integration.

- This is carried out through investments- in the form of loans, grants and information sharing in infrastructure, health care services, financial and public administration systems, helping nations prepare for the impact of climate change or better their natural resources, as well as other areas.

Focus Areas

- Infrastructure: including transport and communications, energy, water supply and sanitation, and urban development.

- Agriculture and Food Security: ADB’s efforts and strategy to achieve food security in the region emphasizes on the integration of agricultural productivity, market connectivity, and resilience against shocks and climate change impacts as the three pillars to achieve sustainable food security.

- Climate Change and Disaster Risk Management: Meeting the growing demand for energy and natural resources is destabilizing our climate, and threatening the development of Asia and the Pacific. The poor are particularly vulnerable to these changes and are already suffering from rising sea levels and increasingly devastating storms, droughts, and floods.

- Education: Despite dramatic rise in primary education enrollment rates in the last three decades, daunting challenges remain, threatening economic and social growth.

- Environment: ADB’s long-term strategic framework for 2008-2020 identifies environmentally sustainable growth as a key strategic development agenda, and environment as a core area for support.

- Finance Sector: ADB has been supporting Financial Sector Development of developing member countries in the Asia and Pacific region in many ways. Financial sector operations since 1966 have accounted for about 10% of total ADB operations.

- Gender and Development: Gender equality and women’s empowerment are essential for meeting Asia’s aspirations of inclusive and sustainable development. Gender equality needs to be pursued in its own right for a just and equal society, and for better development outcomes.

- Governance and Public Management: Poor governance holds back and distorts the process of development, and has a disproportionate impact on the poorer and weaker sections of society. Assisting developing countries in improving governance is therefore a strategic priority of ADB in its work to eliminate poverty in Asia and the Pacific.

- Health: Health is a human right and is essential to development. Good health improves learning capacity, worker productivity, and income. ADB is committed to improving health in Asia and the Pacific by supporting better governance and spending, infrastructure development, and regional collaboration to control communicable diseases.

- Public-Private Partnerships (PPP): Public-private partnerships can play an important role in addressing infrastructure needs in developing Asia and the Pacific.

- Regional Cooperation and Integration: Regional cooperation and integration (RCI) is a process by which national economies become more interconnected regionally. RCI plays a critical role in accelerating economic growth, reducing poverty and economic disparity, raising productivity and employment, and strengthening institutions.

- Social Development and Poverty: Despite substantial improvements in living standards across Asia and the Pacific, hundreds of millions are still excluded from the benefits of rapid economic growth. The region needs social development programs to reduce poverty, inequality, and vulnerability among the poor.

- Sustainable Development Goals: In September 2015 world leaders adopted the 2030 Agenda for Sustainable Development, which includes a set of 17 Sustainable Development Goals (SDGs) to end poverty, fight inequality, and tackle climate change by 2030. ADB supports its member countries in achieving the SDGs through investment in human needs, infrastructure, and cross-border public goods.

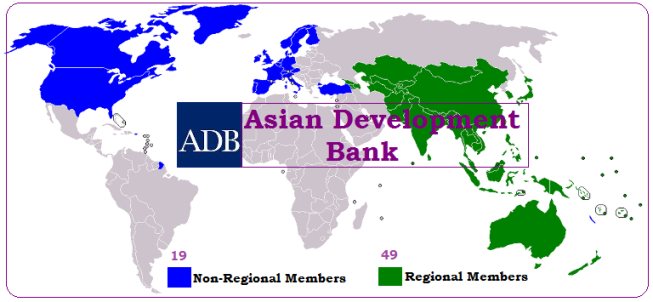

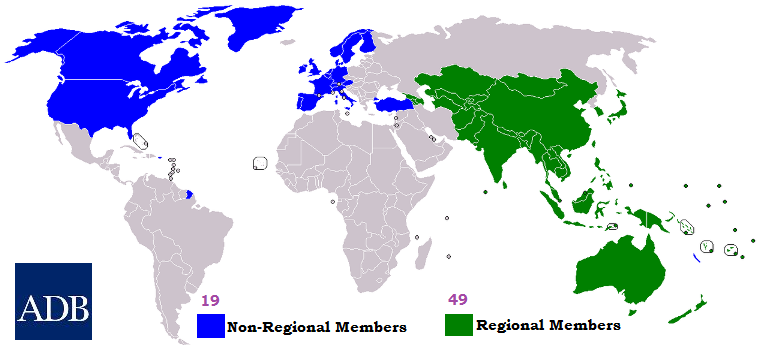

Membership

- From 31 members at its establishment in 1966, ADB has 68 members: 49 members from the Asian and Pacific Region, 19 members from Other Regions.

- Top members by subscribed capital and voting power: Japan (15.6% /12.8%), USA (15.6% /12.8%), China (6.4% /5.4%) and India (6.3% /5.3%).

Decision Making

- Board of Governors: The highest policy-making body of the bank is the Board of Governors, composed of one representative from each member state.

- Board of Directors: The Board of Governors, in turn, elect among themselves the twelve members of the Board of Directors and their deputies. Eight of the twelve members come from regional (Asia-Pacific) members while the others come from non-regional members.

- President of Bank: The Board of Governors also elects the bank’s

president, who is the chairperson of the

Board of Directors and manages ADB.

- The president has a term of office lasting five years, and may be re-elected.

- Traditionally, and because Japan is one of the largest shareholders of the bank, the president has always been Japanese.

Funding

- ADB obtains its funding by issuing bonds on the world’s capital markets. It also relies on the contributions of member countries, retained earnings from lending operations, and the repayment of loans.

- The ADB offers “hard” loans on commercial terms primarily to middle income countries in Asia and “soft” loans with lower interest rates to poorer countries in the region, from Ordinary Capital Resources (OCR).

- The Asian Development Fund offers grants that help reduce poverty and improve the quality of life in ADB’s poorest borrowing countries.

- Private Sector (Non-sovereign) Financing: As a catalyst for private investments, ADB provides direct financial assistance to private sector projects. While ADB’s participation is usually limited, it leverages a large amount of funds from commercial sources to finance these projects.

- The ASEAN

Infrastructure Fund is a dedicated fund established by the ASEAN member

nations and ADB to address the ASEAN region’s infrastructure development needs

by mobilizing regional savings, including foreign exchange reserves.

- All ASEAN Infrastructure Fund-financed infrastructure projects are also co-financed by ADB funds.

- ADB is the ASEAN Infrastructure Fund’s administrator, and ADB also provides technical support.

India and ADB

- India was a founding member of ADB and is now the fourth-largest shareholder, but operations in the country began only in 1986, when India opted to become a borrowing member.

- While most of ADB’s financial support went to infrastructure, the wide-ranging portfolio also included agriculture, water resources management, public resource management and governance, private and finance sector development, education, and health.

- Modernization of Industries: The very first loan to the country, which was approved in 1986, was a $100 million loan to the Industrial Credit and Investment Corporation of India. The program helped to expand and modernize medium-sized industries, and supported the introduction of new technologies.

- Balance-of-Payments Crisis: India’s balance-of-payments crisis, which hit in 1991, precipitated deep structural reforms. ADB’s $300 million Financial Sector Program Loan to India in 1992 infused money into the crippled banking sector and financed wide-ranging reforms that helped develop the finance sector.

- Support to States: The state government developed and implemented infrastructure, clean water and energy projects. ADB has also sought to assist state governments directly, helping to deepen and spread the financial reform process across the country.

- Infrastructure and Clean Energy: India was ADB’s largest borrower for energy projects from 2007 to 2015, accounting for 25% of ADB’s total investments in energy projects in Asia and the Pacific. Rural Roads Sector in India is a Investment Program by ADB

- Private Sector Opportunities: ADB’s support for solar power programs is also helping break down barriers to more private sector investment, including foreign direct investment, in clean energy infrastructure.

Asian Development Outlook 2019: Strengthening Disaster Resilience

- Asian Development Outlook is an annual publication produced by the Asian Development Bank (ADB). It offers economic analysis and forecasts, as well as an examination of social development issues, for most countries in Asia.

Home

Home Syllabus

Syllabus Contact Us

Contact Us