Monetary policy refers to the policy of the central bank (i.e. Reserve Bank of India) to control inflation and achieve the ultimate objective of economic policy in the country. It has fundamentally three components which are achieved through Monetary Policy Instruments:

- Regulation of interest rate

- Regulation of money supply

- Regulation of credit

Role of RBI:

- As a lender of last resort:

- As the total amount of money stock in the economy is much greater than the volume of high powered money (The total liability of the monetary authority of the country).

- Commercial banks create this extra amount of money by giving out a part of their deposits as loans or investment credits.

- In case of a crisis, it stands by the commercial banks as a guarantor and extends loans to ensure the solvency of the latter.

- Banker to the Govt of India:

- Govt of India borrows money by selling treasury bills or government securities to RBI, which issues currency in return (Deficit Financing through central bank borrowing)

- Sterilization by RBI:

- It sterilizes the economy against adverse external shocks (sudden inflow of foreign investment) by open market operation

- Controller of money supply and credit creation in the economy: Through Monetary Policy Instruments

Monetary Policy Instruments: Regulation of Credit by RBI

1. Open Market Operations: These include both, outright purchase and sale of government securities, for injection and absorption of durable liquidity, respectively.

2. Bank Rate Policy: rate of interest commercial banks have to pay RBI if borrowed in case of shortage of reserves.

3. Varying Reserve Requirements: Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR)

Cash Reserve Ratio (CRR): The average daily balance that a bank is required to maintain with the Reserve Bank as a share of such percentage of its Net demand and time liabilities (NDTL) that the Reserve Bank may notify from time to time.

Statutory Liquidity Ratio (SLR): The share of NDTL that a bank is required to maintain in safe and liquid assets (e.g. government securities, cash and gold, etc). Changes in SLR often influence the availability of resources in the banking system for lending to the private sector.

Marginal Standing Facility (MSF): A facility under which scheduled commercial banks can borrow an additional amount of overnight money from the Reserve Bank by dipping into their Statutory Liquidity Ratio (SLR) portfolio up to a limit at a penal rate of interest. This provides a safety valve against unanticipated liquidity shocks to the banking system.

4. Liquidity Adjustment Facility (LAF): The primary aim of such an operation is to assist banks to adjust to their day-to-day mismatches in liquidity, via repo and reverse rep operations.

Under the repo or repurchase option, banks borrow money from the RBI via the sale of securities with an agreement to purchase the securities back at a fixed rate at a future date. Under the reverse repo operation, the RBI borrows money from the banks, draining liquidity out from the system.

Repo Rate: The (fixed) interest rate at which the Reserve Bank provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

Reverse Repo Rate: The (fixed) interest rate at which the Reserve Bank absorbs liquidity, on an overnight basis, from banks against the collateral of eligible government securities under the LAF.

Cheap money policy refers to a monetary policy by the central bank where the central bank sets low interest rates so that credit is easily available to the general public in order to bring efficiency in trade and commerce in an economy.

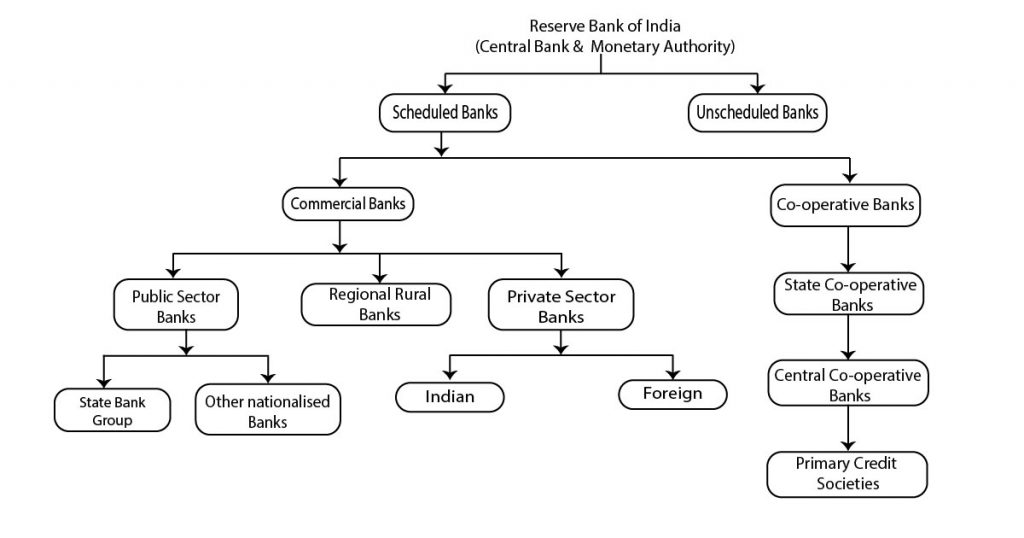

Structure of Indian Banking and Non-Banking Financial Institutions

Scheduled Banks are the ones covered in the second schedule of the Reserve Bank, whereas Non–Scheduled Banks are the banks that are not covered in the second schedule of the Reserve Bank. Scheduled Banks need to maintain cash reserves with RBI, at the rates prescribed by it. Non-scheduled banks are also subject to the statutory cash reserve requirement, but they may keep with themselves.

Commercial Bank is a bank that is formed for the commercial purpose and hence its primary aim to earn profit from the banking business.

On the other hand, Cooperative Banks are owned and operated by the members for a common purpose i.e. to provide financial service to agriculturists and small businessmen. It relies on the on the principles of cooperation, such as open membership, democratic decision making, mutual help.

Non-Banking Financial Institutions

Non-Banking Financial Company (NBFC): A company registered under the Companies Act, 1956 and is engaged in the business of loans, advances and deposits (time deposits only).

NBFCs are doing functions akin to that of banks; however there are a few differences:

- NBFC cannot accept demand deposits;

- NBFC is not a part of the payment and settlement system and as such an NBFC cannot issue cheques drawn on it.

Time Deposit Vs Demand Deposit: Term Deposits, also known as Time Deposits, are investment deposits made for a predetermined period, ranging from a few months to several years. Demand Deposit accounts offer greater liquidity and ease of access as compared to term deposits.

Micro Finance Institution (MFI): Micro Finance Institution is nothing but a type of NBFC which generally provide loans and other financial services to poor sections of the society. Generally, they operate in rural areas and among low-income urban people by extending small loans.

Banks provide the fund to MFIs and thereafter MFIs lend to low-income households based on the group lending method.

Non-Banking Financial Institutions in Economic Development:

Non-Banking Financial Companies are playing a significant role in providing accessible and affordable financial services. The NBFCs are becoming a vital player in financial inclusions indirectly boosting the economy. They contribute to the economy in the following manner:

- Mobilization of assets: NBFCs provide funds and capitals. NBFCs create a balance between intra-regional income and asset distribution. Proper organization of capital will surely help in the development of the trade and industry leading to the economic expansion and progress.

- Providing long-term credits: Unlike other traditional banks, NBFCs offer long-term credit to trade and commerce industry. Long-term credit allows sustainable growth and development of economic sector with stable and softening interest rates. NFBCs are also engaging in funding small-scale industries and MSMEs which will create a base for the development and growth of the economy.

- Upliftment in the employment sector: NBFCs help in achieving full employment in the economy by working with the government and investing in the private sectors. The NBFCs lead to increase in the capital stock which results in employment growth.

- Enhancing the financial inclusion: The NBFCs cater the urban and rural poor companies that have a complementary role in the financial inclusion. Microfinance plays an important role to attain stable financial inclusions. These companies highlight the public issues of corporations and provide the funds needed by the start-up companies as capital.

- Nurturing the standard of living: The NBFCs are highly promoting the living standards of the masses as they are collaborating with the government as well as private sector with their operations. The progressive increase in emerging businesses consequently raising the demand for manpower and creates employment leading to raise the Purchasing Power Parity (PPP) of people and upgrading their living standards.

Banking Sector Reforms Since 1991

In the backdrop of 1991 Crisis New Economic Policy was launched with focus on:

1. Structural adjustment: to reduce current rigidity and bottle necks

2. Stabilization program: to bring the economy back

Narasimhan Committee Report I (1991): Committee on the Financial System

On the recommendations of Narasimhan Committee the following reforms were undertaken in the Banking Sector:

- Lowering SLR and CRR: to ensure more funds availability with the banks

- Professionalism in banking: targeting 0 NPA, proper disclosure of income, classification of assets, Recovery Tribunals established, etc.

- More autonomy in banking: in operating branches (including opening Local Area Banks), deregulation of interest rates, banking open to private sector, etc.

- Reformation in the role of RBI: as a regulator rather than owner, started a new department for the supervision of banks

The East Asian crisis in 1997 led to a heightened appreciation of the importance of a strong banking system, not just for efficient financial intermediation but also as an essential condition for macroeconomic stability.

Narasimham Committee Report II (1998): Committee on Banking Sector Reforms

It put forward the following recommendations.

- Merger of banks to form stronger banks: for handling problems regarding domestic liquidity and exchange rate management in the light of Current Account Convertibility.

- Narrow Banking : weak banks to be allowed to place their funds only in the short term and risk-free assets to reduce their NPAs.

- More professionalism and autonomy in banking: more autonomy in the form of management and ownership; reviewing bank recruitment, etc

- Technical upgradation in banking: faster computerization, technology up gradation, training of staff, etc.

Nachiket Mor Committee (2013): Committee on Comprehensive Financial Services for Small Businesses and Low-Income Households

In its final report, the Committee has outlined six vision statements for full financial inclusion and financial deepening in India:

- Universal electronic bank account: bank account for every citizen

- Ubiquitous access to payment and deposit services: banking facilities at reach

- Sufficient access to affordable formal credit

- Universal access to deposit and investment products

- Universal access to insurance and risk management products

- Right to suitability: right to offered only suitable financial services

PJ Nayak Committee (2014): Committee to Review Governance of Boards of Banks in India

- Reduction in stakes in Public Sector Banks (PSBs): to reduce Govt stake below 50% to provide more autonomy in the board

- Establishment of a Bank Investment Company (BIC): transfer of stakes in PSBs to it, to be managed entirely by bankers with sufficient autonomy

- Establishment of a temporary body called the Bank Boards Bureau (BBB): till BIC is formed and to be dissolved after the formation of BIC

- Governance Reforms in banks: position of Chairman and Managing Director to be split and a fixed term for them

More Topics from Paper-V: Economics

Home

Home Syllabus

Syllabus Contact Us

Contact Us