For Basics of State Finance and Budget, please go through Fiscal Policy: Budget, Fiscal Deficit, Public Debt.

Chhattisgarh Budget Analysis (2019-20)

Budget Highlights:

| Head | 2018-19 (Revised) | 2019-20 (Estimate) |

| Gross State Domestic Product (GSDP) | Rs 3,11,000 Crore | Rs 3,63,900 Crore 17% higher than 2018-19 |

| Total Expenditure | Rs 95,050 Crore | Rs 93,816 Crore 1.3% lesser than 2018-19 |

| Capital Expenditure | Rs 14,700 Crore | Rs 15,222 Crore |

| Revenue Expenditure | Rs 80,360 Crore | Rs 78,595 Crore |

| Total Receipts (excluding borrowings) | Rs 74240 Crore | Rs 80,029 Crore 7.8% higher than 2018-19 |

| Capital Receipts | Rs 14,737 Crore | Rs 14,103 Crore |

| Revenue Receipts | Rs 74,028 Crore | Rs 79,746 Crore |

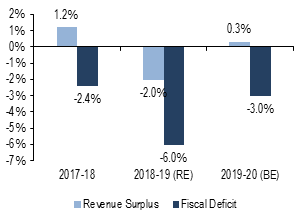

| Revenue Surplus | (-) Rs 6,342 Crore | Rs 1,151 Crore 0.32% of GSDP |

| Fiscal Deficit | Rs 9,997 Crore | Rs 10,881 Crore 2.99% of GSDP |

- The sectors of Rural Development (17%), Police (9%), and Transport (4%) saw the highest increase in allocations while Water Supply and Housing Development budget reduced by 26% in comparison with that of 2018-19 Budget (Revised).

- Debt Servicing (Debt Repayment and Interest Payments) for 2019-20 constitutes about 8% of Total Expenditure.

- The budget has 32% allocation for ST Areas and 11% for SC Areas, whereas Social Areas have been allocated 36% of the budget.

Receipts:

- Out of Total Revenue Receipts, Rs 31,755 (40% of the revenue receipts) Crore will be raised by the state through its own resources, and Rs 47,991 Crore (60% of the revenue receipts) will be devolved by the centre in the form of grants and the state’s share in taxes.

- In the 2018-19 Budget, Chhattisgarh had estimated a revenue surplus of Rs 4,445 Crore. However, as per the revised estimates of 2018-19, this changed to a revenue deficit of Rs 6,342 Crore. The increased expenditure on food grain crops and assistance to co-operative societies contributed significantly to the reversal of Chhattisgarh from a revenue surplus state to a revenue deficit state.

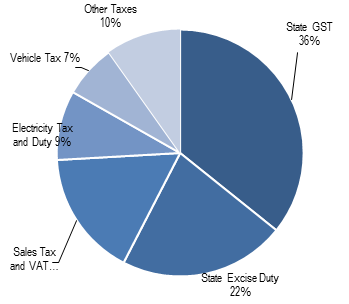

Tax Structure (Composition):

- Chhattisgarh’s total GST revenue (including central transfers) is estimated to be Rs 18,180 Crore in 2019-20, an increase of 4.7% over the revised estimate of 2018-19. It is estimated to be 23% of the state’s revenue receipts.

- Total own tax revenue of Chhattisgarh is estimated to be Rs 22,930 Crore in 2019-20. The composition of the state’s tax revenue is shown. The tax to GSDP ratio is targeted at 6% in 2019-20, which is lower than the revised estimate of 7% in 2018-19. This implies that growth in collection of taxes is estimated to be lower than the growth in the economy.

Expenditure:

- Capital expenditure includes expenditure affecting the assets and liabilities of the state, such as: (i) capital outlay, i.e. expenditure which leads to creation of assets (such as bridges and hospitals), and (ii) repayment and grant of loans by the state government.

- Revenue expenditure includes payment of salaries, maintenance, etc.

- Committed liabilities of a state typically include expenditure on payment of salaries, pensions, and interest payments. Between 2016 and 2019, Chhattisgarh spent 30% of its budget on committed liabilities. States, on an average, spend 39% of their budget on committed liabilities. In 2019-20, Chhattisgarh has estimated to spend Rs 19,294 Crore on salaries, and Rs 4,699 Crore on interest payment.

Policy Highlights:

- Loan Waiver: An amount of Rs 5,000 Crore has been allocated for the waiver of short term agriculture loans. These include loans from rural, co-operative, public sector, and commercial banks. Further, this waiver seeks to benefit around 20 lakh farmers.

- Agriculture and Food Security: Rs 5,000 Crore has been allocated for procurement of food grain crops at the rate of Rs 2,500 per quintal for the financial year 2019-20. In order to fight malnutrition and provide for food security, poor families will be provided with 35 kg rice per ration card. Rs4,000 Crore has been allocated for this purpose under the Chief Minister Food Security Program.

- Suraji Gaon Yojana will be started for rural development and employment generation. It will focus on water resource management, animal husbandry, waste disposal, and horticulture.

- Tendu Patta Remuneration: For minor forest produce Tendu Patta, collection remuneration was increased from Rs 2,500/sack to Rs 4,000/sack.

- Police: Rs 45 crore has been allocated towards response allowance for police personnel.

Chhattisgarh’s Economy

- The per capita GSDP of Chhattisgarh in 2017-18 (at current prices) was Rs 1,02,762. This is 9.4% higher than the per capita GSDP of 2016-17 (Rs 93,890).

- The growth rate of GSDP (at current prices) has increased from 5.9% in 2015-16 to 11.2% in 2017-18.

- The GSDP growth rate (at constant price) is estimated to be 6.08% whereas the All India GDP growth rate is estimated to be 7.2%.

- In 2017-18, the sectors of agriculture, manufacturing, and services contributed to 30%, 33% and 37% of the Gross State Value Added (GSVA). In the same years, these sectors grew by 11.2%, 8.7% and 12.8%, respectively.

- In 2018-19, agriculture, manufacturing, and services sectors are estimated to contribute by 17.2%, 47.2% and 35.6% to GSDP.

Public Debt Composition

Article 292: Government of India can borrow amounts specified by the Parliament from time to time.

Article 293: State Governments in India can borrow only from internal sources.

Thus the Government of India incurs both external and internal debt, while State Governments incur only internal debt.

Definition:

Public Debt: Debt contracted against the guarantee of Consolidated Fund of India (defined as Public Debt)

- Internal debt: owed to

lenders within the country.

- The government borrows by issuing the Government Bonds and T-Bills (Treasury Bills).

- Securities issued to International Financial Institutions

- Borrowing from RBI under Market Stabilization Scheme (MSS) Bonds for sterilization operations

- External debt: owed to

creditors outside the country.

- The outsider creditors can be foreign governments, International Financial Institutions such as World Bank, Asian Development Bank etc., corporate and foreign private households.

- External debt may be of several kinds such as multilateral, bilateral, IMF loans, Trade credits, External commercial borrowings etc.

- When the non-resident Indians park their funds in India, it is also a type of external debt and is called NRI deposits.

Other Liabilities: Liabilities in the Public Account (called as Other Liabilities):

- Liabilities on account of Provident Funds

- Reserve Funds and Deposits, Other Accounts, etc

- Securities issued against ‘Small Savings’: All deposits under small savings schemes are credited to the National Small Savings Fund (NSSF). The balance in the NSSF (net of withdrawals) is invested in special Government securities.

Outstanding Liabilities: Accumulation of borrowings over the years, expected at 21.2% of the GSDP

| Year | 2016-17 | 2017-18 | 2018-19 | 2019-20 |

| Chhattisgarh | 16.6% | 18.6% | 21.1% | 21.2% |

All India Public Debt (2018-19)

| Public Debt External Debts | 40.6% 2.7% |

| Public Accounts | 4.7% |

| Total Liabilities | 45.4% |

| Fiscal Deficit | 3.4% |

Home

Home Syllabus

Syllabus Contact Us

Contact Us