For Basics of State Finance and Budget, please go through Fiscal Policy: Budget, Fiscal Deficit, Public Debt.

Chhattisgarh Budget Analysis (2020-20)

Budget Highlights:

| Head | 2019-20 (Revised-RE) | 2020-21 (Estimate-BE) |

| Gross State Domestic Product (GSDP) | Rs 3,25993 Crore | Rs 3,62,214 Crore 10% higher than 2019-20 (RE) |

| Total Expenditure | Rs 99,975 Crore | Rs 1,00,491 Crore 0.5% increase over 2019-20 (RE) |

| Capital Expenditure | Rs 14,849 Crore | Rs 19,091 Crore 28.6% increase over 2019-20 (RE) |

| Revenue Expenditure | Rs 85,125 Crore | Rs 81,400 Crore 4.4% increase over 2019-20 (RE) |

| Total Receipts | Rs 89,799 Crore | Rs 99,833 Crore 11.2% higher than 2019-20 (RE) |

| Capital Receipts | Rs 14,103 Crore | Rs 16,001 Crore 13.5% higher than 2019-20 (RE) |

| Revenue Receipts | Rs 75,696 Crore | Rs 84,131 Crore 10.7% higher than 2019-20 (RE) |

| Revenue Surplus | (-) Rs 9,429 Crore (-) 2.86% of GSDP | Rs 2,431 Crore 0.67% of GSDP |

| Fiscal Deficit | Rs 21,089 Crore 6.41% of GSDP | Rs 11,518 Crore 3.18% of GSDP |

| Primary Deficit | Rs 16,279 Crore 4.95% of GSDP | Rs 5,678 Crore 1.57% of GSDP |

- In 2020-21, the sector of Irrigation and Flood Control (23%), Education (9%) and Police (8%) saw the highest increase in allocations over the revised estimate of previous year. Agriculture (27%) saw the largest decline in allocation over the revised estimate of previous year.

- In the Budget 2020-21, 38% provision is for social sector, 40% for the economic sector and 22% is for the general service sector.The budget has 34% allocation for ST Areas and 12% for SC Areas, whereas Social Areas have been allocated 38% of the budget. In social sector, School Education constitutes the highest budget of 16.2% while in economic sector, Panchayat and Rural Development constitutes the highest budget of 9.4%.

Receipts:

- The total revenue receipts for 2020-21 are estimated to be Rs 83,831 Crore (10.7% more over RE 2019-20). Of this, Rs 35,370 crore (42% of the revenue receipts) will be raised through state’s own resources, and Rs 48,461 Crore from central transfers, i.e. state’s share in central taxes and grants-in-aid from the central government.

- In the 2020-21 Budget, Chhattisgarh had estimated a revenue surplus of Rs 2,431 Crore (or 0.7% of GSDP). In 2019-20 budget, the state had estimated a revenue surplus of Rs 1,151 Crore (0.35% of GSDP). However, as per the revised estimate for the year, the revenue deficit stood at Rs 9,429 Crore (2.86% of GSDP).

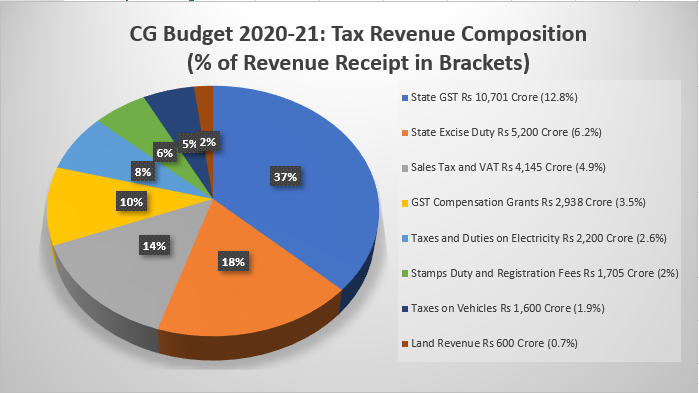

Tax Structure (Composition):

- State Goods and Services Tax (SGST) is the largest component of the state’s tax revenue. It is expected to generate Rs 10,701 Crore in 2020-21. (12.2% increase from RE 2019-20).

- Total own tax revenue of Chhattisgarh is estimated to be Rs 26,155 Crore in 2020-21 (31% of revenue receipts) which is 3.8% higher than the 2019-20 RE. The composition of the state’s tax revenue is shown.

- The tax to GSDP ratio is targeted at 7.2% in 2020-21, which is lower than the revised estimate of 7.7% in 2019-20. This implies that growth in collection of taxes is estimated to be lower than the growth in the economy.

Expenditure:

- Capital expenditure includes expenditure affecting the assets and liabilities of the state, such as: (i) capital outlay, i.e. expenditure which leads to creation of assets (such as bridges and hospitals), and (ii) repayment and grant of loans by the state government.

- Debt Servicing (Debt Repayment and Interest Payments) for 2020-21 constitutes about Rs 10,682 Crore (10.6% of Total Expenditure). This includes Rs 4,841 crore towards repaying loans, and Rs 5,841 crore towards making interest payments.

- In 2020-21, 35% of the total capital outlay is towards Transport, and another 17% is towards Irrigation and Flood Control. Capital outlay denotes expenditure which leads to creation of assets.

- Committed expenditure: Committed expenditure of a state typically includes expenditure on payment of salaries, pensions, and interest. In 2020-21, the state is estimated to spend Rs 38,066 crore on committed expenditure and more than two-third of the state’s committed expenditure (68%) is on salaries.

- Revenue expenditure includes payment of salaries, pension, and interest, etc.

- Revenue expenditure for 2020-21 is proposed to be Rs 81,400 crore, which is a decrease of 4.4% over the revised estimates of 2019-20.

Policy Highlights:

- Rajiv Gandhi Kisaan Nyay Yojana: Rs 5,100 crore has been allocated for providing bonus on paddy procurement.

- Mukhyamantri Suposhan Yojana: to eliminate malnutrition and anaemia in the state. Rs 60 crore has been allocated for this purpose.

- All families of state are now included in universal public distribution system. State has 65 lakh 22 thousand ration card holders. Provision of 3,410 crore has been made for rice distribution through these cards.

- Dr. Khubchand Baghel Swasthya Sahayta Yojana: Priority and Antyodaya ration card holder families will be eligible for cashless medical treatment of up to Rs 5 lakh. For other ration card holder families, the limit is Rs 50,000. Rs 550 crore has been allocated for providing cashless medical treatment to 65 lakh families.

- Mukhyamantri Vishesh Swasthya SahaytaYojana: Provision of 50 crore for treatment of critical illnesses upto 20 lakh.

- Rs 225 crore was announced for the Jal Jeevan Mission.

- Krishak Jeevan Jyoti Yojana: Rs 2,300 has been allocated towards providing free electricity for agriculture pumps of up to 5 HP.

- Rs 396 crore and Rs 300 crore have been allocated for the Smart Cities Mission and AMRUT scheme.

- Provision of 850 crore for half the electricity bills up to 400 units for domestic electricity consumers

- Provision of 50 crore in the new item for the Rajiv Yuva Mitan Club Scheme. Provision of 5 crore in the new item for the Youth Festival.

- Rs 2,520 crore has been provided for expenditure on district police.

- Gurukul Vidyalaya will be set up in Giroudhpuri, the birthplace of great sege Shree Guru Ghasidas.

- Special Junior Staff Selection Board has been constituted for recruitment to the third and fourth category posts of district cadre for Surguja and Bastar divisions and Korba districts.

- A revolving fund of Rs 10 lakh will be made available to self-help groups for the establishment of Garh-Kalewa in other 27district headquarters.

- Provision of 10 crore for infrastructure development and construction at 9 major tourist centres identified on the route used by Shri Ram-Janki under Ram Van Gaman tourism circuit.

- Shahid Smarak will be constructed in Nawa Raipur in the memory of the martyrs of Jhiram Valley.

15th Finance Commission’s recommendations for 2020-21

The 15th Finance Commission’s (15th FC) report for the financial year 2020-21 was tabled in Parliament on February 1, 2020. The 15th FC recommended a 41% share for states in the central government’s tax revenue in 2020-21, a 1% decrease from the 42% share recommended by the 14th FC (2015-20). The 1% decrease is to provide funds to the newly formed union territories of Jammu and Kashmir, and Ladakh from the share of the central government. The 15th FC also proposed revised criteria for determining the share of individual states.

The 15th FC has recommended a 1.4% share for Chhattisgarh in the Centre’s tax revenue for 2020-21 (an increase from the 1.29% share recommended by the 14th FC for 2015-20). The estimated devolution to Chhattisgarh by the Centre for 2019-20 (RE) was Rs 20,206 Crore and 2020-21 (BE) is Rs 26,803 Crore.

In addition, the 15th FC has also recommended certain grants-in-aid for various purposes for the year 2020-21. Chhattisgarh will receive Rs 2,154 Crore (this consists of Rs 1,454 crore for rural local bodies and Rs 700 crore for urban local bodies), and Rs 432 crore as grants for calamity relief.

Chhattisgarh’s Economy

- Chhattisgarh GSDP is likely to grow to 3.29 Lakh Crore during 2019-20 from 3.04 Lakh crore in 2018-19 at current prices. The per capita income of Chhattisgarh in 2019-20 is estimated at Rs 98,281 (6.3% higher than that of 2018-19).

- The growth rate of GSDP (at constant prices) is estimated to be 6.08% in 2019-20, a decline from the 7.1% growth rate in 2018-19. All India GDP is likely to grow by 7.06% on constant prices in the same duration.

- In 2019-20, agriculture, manufacturing, and services sectors are estimated to contribute by 17%, 46% and 37% to GSDP respectively. During year 2019-20GSDP of Chhattisgarh State is likely to grow in agriculture sector by 3.31%, industrial sector by 4.94% and services sector by6.6% on constant prices. All IndiaGDP is likely to grow in agriculture and industrial sector by 2.8%& 2.5% respectively for the same duration.

- According to the Periodic Labour Force Survey (2017-18), Chhattisgarh had an unemployment rate of 3.3%, compared to the all-India unemployment rate of 6.1%.

Public Debt Composition

Article 292: Government of India can borrow amounts specified by the Parliament from time to time.

Article 293: State Governments in India can borrow only from internal sources.

Thus the Government of India incurs both external and internal debt, while State Governments incur only internal debt.

Definition:

Public Debt: Debt contracted against the guarantee of Consolidated Fund of India (defined as Public Debt)

- Internal debt: owed to

lenders within the country.

- The government borrows by issuing the Government Bonds and T-Bills (Treasury Bills).

- Securities issued to International Financial Institutions

- Borrowing from RBI under Market Stabilization Scheme (MSS) Bonds for sterilization operations

- External debt: owed to

creditors outside the country.

- The outsider creditors can be foreign governments, International Financial Institutions such as World Bank, Asian Development Bank etc., corporate and foreign private households.

- External debt may be of several kinds such as multilateral, bilateral, IMF loans, Trade credits, External commercial borrowings etc.

- When the non-resident Indians park their funds in India, it is also a type of external debt and is called NRI deposits.

Other Liabilities: Liabilities in the Public Account (called as Other Liabilities):

- Liabilities on account of Provident Funds

- Reserve Funds and Deposits, Other Accounts, etc

- Securities issued against ‘Small Savings’: All deposits under small savings schemes are credited to the National Small Savings Fund (NSSF). The balance in the NSSF (net of withdrawals) is invested in special Government securities.

Outstanding Liabilities: Accumulation of borrowings over the years, expected at 21.6% of the GSDP for 2020-21.

Debt Servicing (Debt Repayment and Interest Payments) for 2020-21 constitutes about Rs 10,682 Crore (10.6% of Total Expenditure). This includes Rs 4,841 crore towards repaying loans, and Rs 5,841 crore towards making interest payments.

| Year | 2016-17 | 2017-18 | 2018-19 | 2019-20 (RE) | 2020-21 (BE) |

| Chhattisgarh | 16.6% | 18.6% | 17.4% | 20.2% | 21.6% |

All India Public Debt as percentage of GDP (2018-19)

| Public Debt External Debts | 40.0% 2.7% |

| Public Accounts | 5.2% |

| Total Liabilities | 45.7% |

| Fiscal Deficit | 3.4% |

Economy of India and Chhattisgarh

Home

Home Syllabus

Syllabus Contact Us

Contact Us