Literally, Co-operation means working together and a co-operative society is a voluntary association of individuals having common needs who join hands for the achievement of common economic interest. Its aim is to serve the interest of the poorer sections of society through the principle of elf-help and mutual help.

The main objective is to provide support to the members. Nobody joins a cooperative society to earn profit. People come forward as a group, pool their individual resources, utilize them in the best possible manner, and derive some common benefit out of it.

Provisions of Indian Constitution

1. Directive Principles of State Policy enshrines under article 43 (Living wage, etc., for workers) The State shall endeavor to secure, by suitable legislation, a living wage, conditions of work ensuring a decent standard of life and full enjoyment of leisure and social and cultural opportunities and, in particular, the State shall endeavor to promote cottage industries on an individual or co-operative basis in rural areas.

2. Right to form cooperatives can also be construed as a Fundamental Right, Article 14 (Right to Equality) and Article 19(1)(c) as ‘Right to form Associations or Unions.

Growth of Cooperatives

After independence cooperatives became an integral part of Five-Year Plans.

1. In 1958, the National Development Council (NDC) had recommended a national policy on cooperatives and also for training of personnel’s and setting up of Co-operative Marketing Societies.

2. In 1984, Parliament of India enacted the Multi-State Cooperative Societies Act to remove the plethora of different laws governing the same types of societies.

3. The most important success stories lays behind the success of White Revolution which made the country the world’s largest producer of milk and milk products; and Green Revolution and the conversion of villages into model villages have assumed great importance in the wake of the Green Revolution.

4. Government of India announced National Policy on Co- operatives in 2002. The ultimate objective of the National Policy is to-

- Provide support for promotion and development of cooperatives

- Reduction of regional imbalances

- Strengthening of cooperative education, training and human resource development

Importance of Cooperative Sector in India

- It provides agricultural credits and funds where state and private sectors have not been able to do very much.

- It provides strategic inputs for the agricultural-sector; consumer societies meet their consumption requirements at concessional rates.

- It helps to overcome the constraints of agricultural development.

Structure of Cooperatives

- Though the Banking Regulation Act came in to force in 1949, the banking laws were made applicable to cooperative societies only in 1966 through an amendment to the Banking Regulation Act, 1949.

- Since then there is duality of control over these banks with banking related functions being regulated by the Reserve Bank and management related functions regulated by respective State Governments/Central Government. (‘Cooperation’ is a state subject. )

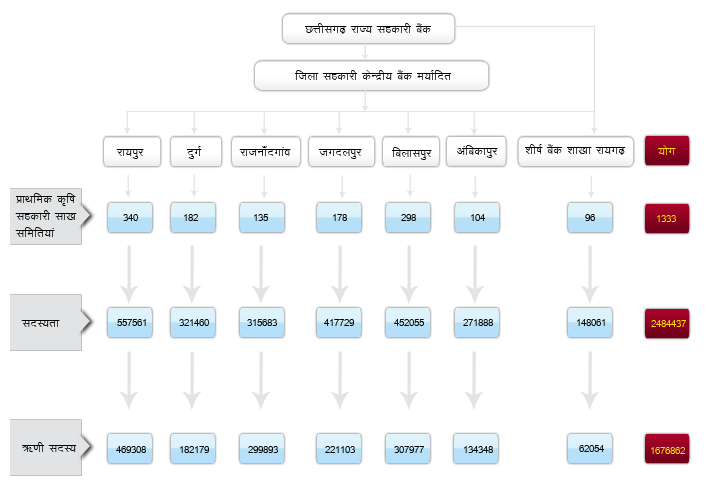

- The short-term co-operative credit structure operates with a three-tier systems:

- Primary Agricultural Credit Societies (PACS) at the village level,

- Central Cooperative Banks (DCCBs) at the district level

- State Cooperative Banks (SCBs) at the State level.

- PACS are outside the purview of the Banking Regulation Act, 1949 and hence not regulated by the Reserve Bank of India.

- SCBs/DCCBs are registered under the provisions of State Cooperative Societies Act of the State concerned and are regulated by the Reserve Bank.

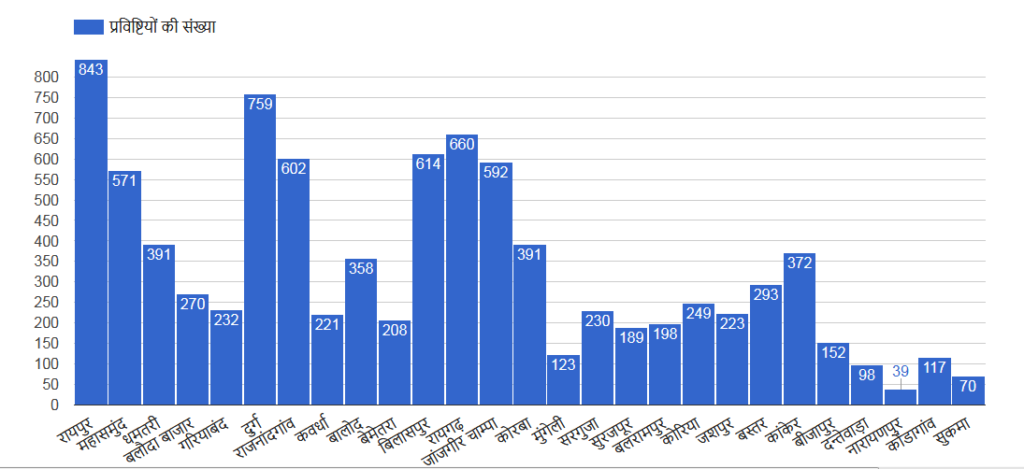

Cooperative Societies in Chhattisgarh

Also read News: Govt not to Merge Distt Co-op Banks with Apex Bank

Challenges for Cooperatives

- The duality in control, however financial regulatory control by RBI has led to many troubles as there is ambiguity in power structure as there is no clear demarcation.

- Patchy growth of cooperative societies across the map of India. It is said these have grown maximally in states of Gujarat, Maharashtra, Tamil Nadu whereas the other parts of India don’t have a heightened presence.

- The state partnership has led to excessive state control and interference. This has eroded the autonomous characters of many of these.

- Dormant membership has made them moribund as there is a lack of active members and lack of professional attitude.

- Their main focus being credit so they have reduced to borrower-driven entities and majority of members are nominal and don’t enjoy voting rights.

- Credit recovery is weak especially in rural areas and it has sustainability crisis in some pockets.

- There is a lack of risk management systems and lack of basic standardized banking models.

- There is a widening gap between the level of skills and the increasing computerization of banks.

Home

Home Syllabus

Syllabus Contact Us

Contact Us